I am extremely biased, but I believe the fields of trading and investing operate as one of the greatest pressure cookers for honing in on core wounds around money; assuming, one has the capacity and wherewithal to approach them with a certain level of awareness.

Not that one needs to be conscious or inwardly focused to make substantial sums of money by any means either, as this is self-evident looking at the world at large, but universal law shows us that rather than simplify the rest of life, unexpected wealth often complicates it considerably, and is a deep initiation in its own right, as cliche and insane as it may sound to you right now.

The reason being that sooner or later every investor must become a philosopher too.

And the best ones eventually become mystics because speculation is an infinite game; a reflection of the uncapped inner heights, and the seemingly bottomless lows.

There is no limit to how much money you can make or lose if you can or can’t sync up to the beat of buying and selling.

If you speculate, you deal with destiny, fate, divine intervention, luck, grace and all the other names of God.

Markets themselves are literal forces of nature; they adhere to the universal rhythms of the collective and cosmos, even if it appears to our naive intellect as the essence of entropy or unscripted chaos. I personally view them in aggregate as one of the best ways of taking a field sample of the the collective unconscious at any given moment.

This becomes more evident by the day as the total market cap for the social and financial phenomena known as memecoins grows exponentially; thought forms, narratives and ideologies stewed in the collective astral field, realized or not, are tokenized instantaneously in the name of potential profit, to which the subjectivity of value moves from dispersion to concentrated agreement in a flash, and the ideas beneath them run the gamut from the most evolved and philanthropic, to the most deranged and twisted.

The malleability of this trending consensus behind its chosen banner is like the membrane of a barrier upon which force is applied then released; like a great undulating wire fence of mania or terror.

As a whole, “the market” acts as one of the most informed organisms on the planet. An egregore; a living sum of human emotional behavior, inclination and belief, mirroring the contracting and expanding of the celestial correspondences, from peak to trough, greed to fear, hope to depression, bull or bear, all reflected in this fluctuation we call price.

As one ventures into the wilderness of speculative markets, the hologram of this intelligence becomes quickly evident.

A beginning investor soon discovers the elements of stochasticity and elasticity; annihilating gravities and near-miraculous levities of price; fibonacci extensions and sequences; regressions and mean reversions; a world of medians and averages; fractal theories of time, inner maps of gambling behaviors, liquidity blackholes; an intuitive understanding of singularities, a rough science of innovations and the felt firsthand intricacies of wave mechanics.

They find themselves awash in universes upon universes of tickers, cashtags and deranged lingo, grasping on the fly the infinite power of momentum as well as inertia, and many other concepts we think are exclusive to physics, mathematics and psychology or other disciplines all seeking to grapple with finding the illusive answer to the question what will happen next?

Contrary to where many veteran traders and investors believed technology was driving the field of financial speculation since the start of the century → moving from the sweaty on-the-spot calculations of the loud trading pit to a sterile and automated process driven by complex computer algorithms → there has actually been a huge renaissance and surge of discretionary, i.e., intuitive trading occurring due in no small part to the easy on-ramp abilities into the stock and sports betting markets via a mobile and app dominated world (think Robinhood), along with the advent of crypto, cheap credit and the proliferation of networks all converging in an age of extravagant monetary policy, which all together really stand as a testament to a key quark in the innate atomics of our human nature:

We simply love to gamble baby.

The continuation of samsara you see all around you is our mystical evidence of this.

For in essence, when we disregard the interconnectedness of life (hologram) and the reality that is cause and effect in this material plane (karma) we make a bet with the divine.

And I’d wager the gambler inside you reading this right now is probably saying “come tfook on lad it ain’t all that deep”

[apologies I’m in London atm (previous financial hub of the world) having a spiritual crisis]

Of course on the surface they’re right; but that’s just the thing isn’t it →

We take the magic that is our intuition for granted, that very thing which the modern rise of trading and investing emphasizes, relies on, and glorifies → our ability to synthesize so many various data streams into a concrete and obvious binary:

Yes or no. Buy or sell. Fight or flight.

Chances are, you are quite familiar with the contemporary adage fuck around and find out, whose veracity is easily and immediately testable →

But whats hiding in the inverse correlate of this paradigm-shifting axiom is hidden a deeper echo of truth that speaks to me more and more (hilariously) each day:

Play stupid games, win stupid prizes.

Because if I zoom in and decipher this holon at an individual energetic level as it pertains to investing, I see the fractal of its intuitive truth quite clearly—if I react hastily out of fear or lack in my decision making, then I am just sowing the seed of that vibration into the future outcome.

Or to put it another way →

The more we fuck around, the more we find out that if we don’t listen to life, we have to play some really dumb games over and over again.

See, what I’ve gleaned from the past 6 or 7 years trading the crypto markets is that each of our individual relationships with risk are vastly complex and entwined with our core programs of identity.

This becomes highly evident as soon as one decides to invest in a potential outcome, whether it be with another human or in a stock, because in that moment we must grapple with our own eternal potential, with the intense gravity of our longing, with the tenacity of our commitment, with the pliability of our trust, with the density our truth, with the integrity of our conviction, with the perceived scarcity of our time.

Because what if I’m wrong? What if I mess up? What if it doesn’t go as planned? What does that say about me as a human?

What does that mean for my livelihood? My worth? My destiny? My peace?

→ What am I actually risking?

→ Am I risking enough?

→ What am I actually risking it for?

Is it for my deepest dream or just the shadow of that dream?

Do I really deserve it?

Am I ready for the change and responsibility that comes with having it?

For me these are the questions with the roots to my most negative self-talk; my deepest delusions.

Even though missing out on millions or losing small fortunes is part of the game—tuition we call it—believe me when I say nothing ever really prepares you for the obnoxious high of unrealized gains, when the powers of compounding alchemize your something minuscule into something immeasurable in its potential impact on your reality; nor is one ever prepared to stomach the sickness of adhering to reason and selling something for a comfortable sum only to watch it exponentially continue onwards after your blood sacrifice to the gods of fortune.

And it goes without saying or further clarification that we are never ever ready when we realize we have risked more than we can stand to lose and end up losing just that, and then some, somehow.

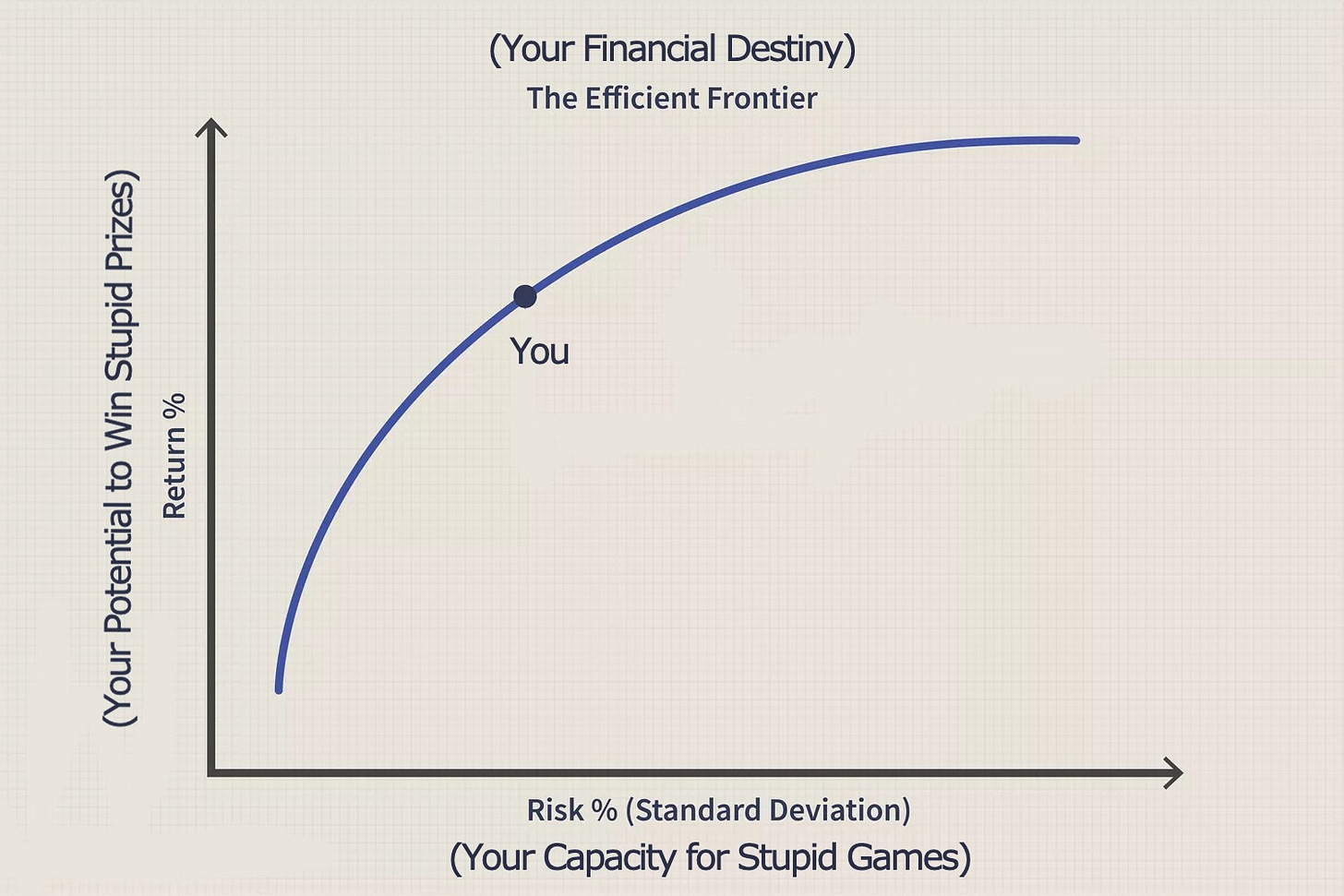

When we inevitably lose, if we aren’t in tune with our risk appetite (how stupid we are willing to get), and thus we aren’t sure what our risk tolerance really is (our capacity to get stupider than we had previously planned on getting) → it hurts (a lot) ((trauma)) and we lose much more than that.

We lose our sanity, we lose our sleep; we lose our ground whenever we fall out of equilibrium within, and we can sometimes do quite irreparable damage to our circumstance.

On the flip side of all that, if we don’t play big enough or make the odds interesting enough, then we never tap into enough energy from the universe for things to actually change in the direction we want.

In a society that prizes money over all, as the key to survival as well as success, where failure is essentially considered poverty, these theaters of chance are bound to incite an existential crisis of a very acute variety to the uninitiated.

But then again that’s how we learn.

True initiations cannot be prepared for.

This is how the game of wealth acquisition has become one of our primary spiritual arenas.

The intensity of ups and downs never goes away, but the longer one survives through the seasons of volatility, the more one’s detachment naturally grows and the more determined one becomes to figuring out the Great Puzzle.

It is actually the volatility of markets that make them such a powerful mirror for those who have the wherewithal to use it as such, for it demands the realization and cultivation of a presence outside our usually default myopic ego-centric worldview, a broader perspective of what intelligence really is, and which leads us to see we are much more than just our emotions.

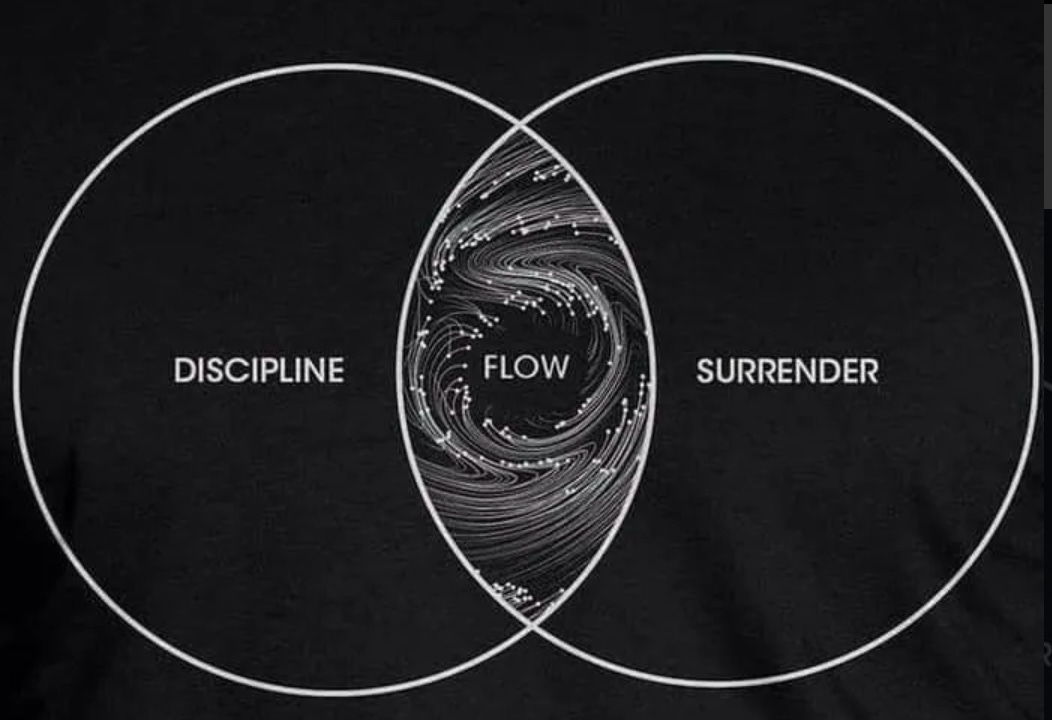

Hence, it is this sense of detachment (and therefore simplicity as a way of accessing detachment) which allows one to enter into the deep and lucrative field of being we call patience.

And trust me when I say the crypto markets are the most volatile markets on earth.

Without this detachment, we’re hosed because we can’t find our way into patience, into the flow. And those who think they’re detached soon find the edge of their limits or miss the boat entirely.

Because as soon things don’t go exactly as expected (which they never will) our internal bargaining with fantasies that were never ours also begins and we start to get antsy, concerned → impatient.

Impatience is always the horror of self-sabotage; the lived atrocity of second-guessing and hesitation; the mirror I am confronted with whenever I act from my fear of missing out instead of my initial truth.

The hell of impatience is always helixed with my greed, because it is my desire for something more that causes me to compromise my integrity (my plan) to get what I want sooner.

So it goes, that time and time again one learns and relearns that the most profitable and perennial strategy for leveling up is to invest in what makes sense to you (believe in something), trust your gut (higher self) and wait to be right (cultivate patience) whether it be an asset, a person, or any potential outcome.

Or perhaps even more important: learn to know when you’re wrong.

The key is to find our own middle path and also accept that the boundaries of that path are always shifting.

That’s exactly what can make patience so damn tricky is that it isn’t static; it is dynamic.

Which means, particularly as it applies to the investment of our money, that there is a time where patience organically gives way to action, and that action, if in alignment, is a fractal of a much greater collective impulse and a much more universal theme.

So how are we supposed to remain patient when everything around appears to be reaching peak stupidity?

In this very moment, understand we are on the cusp—if not yet fully submerged into—an era of rampant financial nihilism.

Inflation guarantees that you must continue to increase the effort at which you work to juice the dream life you want out of the machine.

It doesn’t matter whether it slows down or not. It is an inherent flaw at the system level.

Many lament the tragedy that is the broken system we live in at current and yet the system isn’t in fact broken at all; it actually works exactly as its designed to in a quantum sense, perpetuating the fear from which it is built.

The system isn’t broken—its just clearly bullshit.

“Fucked things will continue to remain perfectly fucked”—that one’s mine.

The basic vibe of late-stage capitalism in nations with fiat-based currency is that everyone essentially becomes a speculator, a trader; a risk-taker. Because everything becomes a measure of opportunity cost.

What am I risking by spending my time doing this while the cost of everything rises?

It is this basic question that breeds impatience at the system level.

The pressure of evolutionary success vs. failure has been broadcasted into every facet of our daily lives via our immersion of our money and therefore our identity with the internet.

Not only do you lose, but you lose infinitely if you let yourself because our tendency towards comparison to other’s success, as well as the fabrication of said ‘success’, has never been easier, i.e →

Play stupid games, win stupid prizes.

In practice, most people really don’t have the luxury to inquire into this question of opportunity cost too long because they are living in the pressurized survival mode manifestation of its consequence; they need groceries, to pay off credit cards, to make rent.

People need to get ahead, which pushes them into longer hours, further compromises of values, and stress.

AND YET, it is becoming extremely self-evident that we are quickly approaching a point where individuals can’t afford to not do something a little risky or they’ll never be able to escape the rat race.

I don’t need to point you to any data about how working a job, two jobs, three jobs, isn’t cutting it anymore. It costs roughly 10 cents a minute just to breathe in Whole Foods now.

This is how the current system forces us out along what we call the risk curve and pushes us into riskier and riskier behaviors so that we can keep up with a certain quality of living.

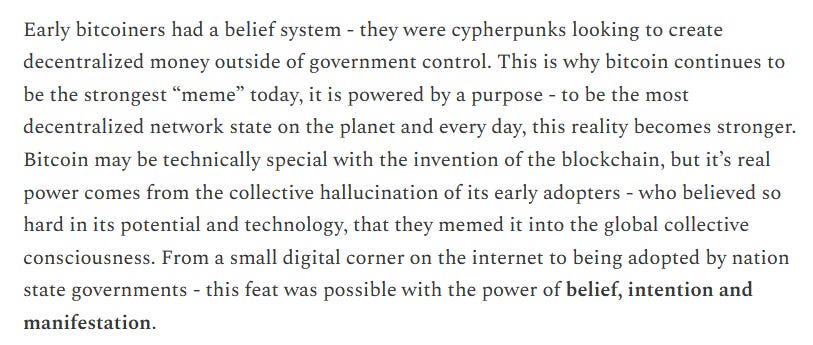

So enter Bitcoin.

By now, you’ve heard of it, but probably still don’t understand wtf is going on, and that’s good because now more than ever you truly don’t need to understand the inner workings of it to make money from it or benefit from its technology.

But it is important to understand that it, and the whole subsequent infinite spiral of blockchain technology that has dovetailed from it’s invention, are about to completely vibe-shift our whole financial foundation, and pretty much already have in an irreversible way.

If you are reading this (ty), then you already know that it is a HIGHLY auspicious (stupid) time, celestially, socially, and financially.

Politics and policy aside, the fed is projected to keep cutting rates in 2025; and regardless, the highly cyclical nature of the crypto markets, plus the Lindy-ness of Bitcoin is hitting escape velocity which has super-expansive implications for digital assets as a whole.

In short, it’s time to place your bets; to take a risk.

From the collective lens, this is only further tangible evidence that we are done with the way things have been at all levels of play, and we are about to see how this extends to our money just as well.

What we call money is currently rapidly changing before our eyes.

Our non-holistic capitalism has been extracting value away from the utility of the underlying asset, the physical good or service, while simultaneously shifting our desire nature from carnal matters to digital ones at such an alarming rate, that the gravity has finally sunk through the bottom of our spacetime-continuum at both ends and we are now in a new financial reality.

Whats trending is what is likely to trend up and to the right.

Ideas are the new dollars.

Attention is the new capital.

Comedy is the new propaganda.

Social media is the new politics.

The markets are the new frontlines of war for many to rise above the overwhelming tides of life and fight against the oppressive economic machine and ‘make it’.

The obvious beauty of investing in a reality where survival of it’s constituents depends on money, and where the acquisition of that money has traditionally been based on its exchange for individual time and effort, is that it allows one’s material destiny to hinge upon the quality of their decision making (infinite) not necessarily the quantity of personal time or energy (finite) they are willing to trade for it.

If you have a good idea, a hunch, an inclination about how things might go, about which way the herd may flock, you can express that opinion in market via a position; and the ability to express that opinion—through the language of financial instruments— has never been easier or more abundant, nor has it ever had the capacity to be so complex.

And if you’re early, quick, or better yet lucky patient with your idea, you can change your fate, because you have unequivocally sourced leverage from some place in your universal sense of self to push you along.

Speculation is always the endgame for players in a system built on scarcity, interference and corruption.

Before the ubiquity of the public forum that is the internet and social media, the financial field was often dominated by spreadsheets, earnings reports, statistics, and other walls of idiosyncratic language.

But in the age of Reddit and Twitter (bite me Elon), transparency and immediate availability of information has allowed us to slowly, then all at once, strip the majority of that waffle away to the absolute kernel of truth behind every such investment decision:

An investment at it’s core, like money itself, is nothing but a shared belief between you and others on what is valuable.

And now we can watch this phenomena happen in real time.

The implications of our continued collective embodiment of the above distillations—that all money is effectively determined by consensus aka memetics—is hyper-accelerating us into peak silliness.

To speak quite plainly, we’ve reached a tipping point as a civilization where we’ve basically agreed everything is a meme because everything can become a meme, and those who are disagreeing are quickly becoming memes themselves.

Rather than let this discourage you, I’m here to say let it empower you.

At a time where consciousness is becoming the same as currency, this means YOU actually have an enormous amount of input as to what could be profitable because YOU are tuned into the collective field.

What is niche to some in their ivory towers and walled gardens, is possibly effortless for you to comprehend. And now the infrastructure is there for that comprehension to be expressed in market, by everyone, quite effortlessly and intuitively.

It means power and authority is returning to the user and away from the system.

And right now there is a vast amount of resources, time and energy being spent on the attempt to anticipate and interpret this very set of your behavioral data.

It means that there is more a call than ever to stand in your spiritual sovereignty amidst the waves of metaphysical forces that are building and using this Cambrian explosion of markets in the modern age to influence, manipulate and denigrate your consciousness through the allure of a quick buck.

When the actual content of our money starts to speak about our principles as a person, not just what we spend our money on →

When our money isn’t just a reflection of our sentience, but is itself becoming sentient*** →

When financial prosperity is not locked behind our understanding of some opaque arbitrary criteria about what constitutes value, but is suddenly dependent upon just what we find valuable to us, and therefore our cohort and community →

A whole new horizon awaits, dragons and all.

Bitcoin is a powerful symbol for claiming and standing in this sovereignty because it represents and requires a new epoch of personal responsibility and accountability for one’s finances, which many have been (understandably) reluctant to take on, and up to this point in history could afford to disregard.

Until now.

Pause.

How are you feeling?

Whatever it is stirring inside you—hope, excitement, inspiration, anxiety, boredom, confusion, fear → the topic of money, let alone investing that money, brings up many emotions, which is why investing is always an art more than a science.

Rest assured, the point here is not to overwhelm but to liberate.

If you’re reading this there is a high chance like many people you feel like you’ve completely missed the boat on bitcoin and crypto and I totally get that. You aren’t alone in that at all.

Even as someone who has been engaged with crypto in almost every capacity over the past few years, I somehow missed the majority of the boat as well.

That’s what happens when we aren’t in a good relationship to ourselves and risk; we make poor decisions.

Even with all my time spent staring at my computer, in the trenches, researching, experimenting, learning, I’d bet you and I are actually in quite a similar situation.

For all my belief in Bitcoin, and my anticipation of where things are headed for us on this awakening timeline, I still own very little, which is very hard to admit, considering the amount of time and effort I’ve traded for it, the amount of identity I’ve squirreled into it.

The subsequent shame that has flowered around this, around losing money that was never mine to begin with but ‘could have been’, plus programs of deep scarcity and the material measuring of my self-worth, has caused me to drag my feet considerably on finishing this essay and the next that touch on BTC because how am I supposed to write about something so fervently that I haven’t actually managed to align myself with?

Literally put my little money where my mouth is? Where’s the humility in that?

It was only recently that I was talking about this with my friend Alyssa Troob (do it, click it) ((🫂)) where she encouraged me to weave that experience in that things shifted enough for me to see a way through.

→ We have such a distorted way of measuring success in our society and that is in large part due to our distortion of time.

We believe if you put in the time, if you sacrifice your time, then you are guaranteed the same measure of reciprocity in the material, but it’s much more nuanced than that.

We (obviously) get rewarded for the risks we take, but this doesn’t necessarily correlate or have anything to do with external behavior at all.

All risk taking first originates from within.

We humans are quite predictable.

We typically have very little interest in anything until everyone has interest in it.

We wait for consensus so we know it’s safe. It’s an animal instinct, an extension of our sense of taste to know whether something is poison or not.

More mystically than that we fear being rejected from the whole and its vital resources; we are afraid to risk looking like a fool.

Even though if we were to really rely on our logic, we would see that the rhythms of fate always favor the bold, and that just like how patience is not static, nor is risk.

There are times where what looks to be risky, is actually the least risky.

Times where the universe calls us to go ALL. IN.

When the correlates don’t make logical sense at all but you just know.

When we get called into a completely new nonsensical direction that we can’t explain the why of to anyone, but our heart is at peace.

To be available to these shoulder taps requires a deep sense of attunement, faith, bravery, courage and no shortage of luck.

Quite the challenge then when waiting for the nod from status quo is the herd mentality of the shadow frequency that blankets our whole planet.

That’s why those who operate from their genius are always viewed as rebels because they seem to operate outside of anything the middle of the bell curve can comprehend.

They look crazy. They look like fools.

But once the herd shifts, it stampedes.

The reason I am drowning out here in London right now is because I just attended a seminar Richard gave on the Dawn of the Future Human, and during this, when explaining keynotes of the new healed leader, he said something that clicked for me:

“A healthy line 3 loves risk.”

No matter what leap we take, in any endeavor, we do it through this aspect of the 3rd line energy. Every catalyst comes through this inner gate.

More than any other line, the third line f’s around and finds out. And consequently is often confronted with the reality of feeling quite stupid sometimes.

But it has to try to know where the edge is—so it knows what’s stupid and what isn’t.

When we are in the Shadow this line energy manifests as a frozen hesitancy to take any risk whatsoever, or a recklessness of self-abandonment and destruction as we gamble beyond our limitations.

But at the Gift Frequency, we all actually love risk, because it is calculated through the medium of our soul-awareness and the Tao.

It is to be awake in a sense of thrill that prisms throughout all aspects of our life.

It is a riveting appreciation of adventure.

At its best, the line 3 laughs joyously in the face of failure, and in doing so transcends the idea of it entirely, via resilience and inventiveness.

These energies of the lines are woven through every Gene Key and every single one of us regardless your design or profile.

Un-ironically it is also this third line that corresponds to the core wound of shame, which is perhaps the most topical wound pattern when it comes to keeping the abundance of universal love from flowing to us, aka money.

Right now, all astrology, prophecy and objective observation screams we are at this ignition point of the third line catalyst collectively (if you want to go further definitely watch the video below).

If you are sensitive to these shifts, you’ve probably been in a tremendous amount of discomfort because life it seems is not just asking us to let go of the old programming any more → it is quite literally forcibly demanding it.

Right now, we are all being asked to get well acquainted with the notion of risk, on more planes than one, in more ways than one.

To make a quantum leap we each individually must RISK a jump.

Every transition into a higher state of being, whether that is wealth or enlightenment, requires the catalytic energy of this line 3 that is present in each one of our cells to risk the narrow framework of what we know into the ever-expansive potential that is the unknown.

We must follow the pain within (line 1) so that we can get our relationship to self (line 2) right and risk (line 3) aiming for the mountain top and being rejected (line 4) if we are to look honestly at the massive generational guilt aka karmic debt (line 5) that plagues our society and move into a new age (line 6).

So, rather than write a long practical list about why you should invest in Bitcoin, which many have already done extensively, I’m writing this to help point to the place inside that has probably stopped you from buying it, or buying more of it, in the first place →

To help explore the architecture of the energies at play as it relates to the concept of risk so that we can look at the fear with lucidity, because we are at a moment where everything we know about what feels safe is going to be challenged.

A leap inwardly reflects a new paradigm outwardly, through the laws of correspondence; as above, so below; as within, so without; from the old, comes the new.

The intrinsic nature of risk has changed.

Now it’s officially more risky to not have any exposure to bitcoin to hedge against the collective sickness that is inflation, and soon that will likely shift from a hedge against inflation/ store-of-value to a hedge against centralized political and economic uncertainty.

If you’re gonna save money, to me it makes the most sense now more than ever to do it in bitcoin—not as a speculation on selling it the future—but as a means to ensure the effort towards your livelihood does not wither away from the oppression that is a decaying money supply.

Not as a result of panic, but as of recognizing and responding to a greater collective current of which you are a part of so that you can stay grounded against the insanity of pervasive market forces that are growing wilder and wilder by the minute, in a reality that is starting to commodify everything.

I want to invite you into seeing the possibility that when it comes to Bitcoin and crypto, you still have massive upside to gain, spiritually and materially.

I believe anything under $100k per BTC is wildly cheap for this decade. Anything under a million is cheap for the next decade.

In fact, I don’t think the opportunity that is Bitcoin has ever been more abundant, except perhaps since its inception/ circa 2013, to those who are patient ***

The truth is if you’ve held off to this point, you’ve actually likely done yourself a massive service because many have lost fortunes big and small to a nascent and treacherous UI/UX infrastructure, that until very recently was not forgiving in the slightest.

Basically if you had invested in anything other than Bitcoin and done anything except hold it, the probability of you having lost that money in the name of experimentation over the past decade (line 3) is incredibly high.

But these continued stress tests of Bitcoin’s thesis over the years as an alternate store-of-value, and the continued adoption of bitcoin into the legacy financial system via different instruments and derivatives has reduced the tail-risk of ruin and individual anxiety significantly.

Simply put, if you’ve held off til now it’s probably because you actually have a healthy relationship with risk.

But the time for waiting patiently to see what will happen has officially ended and the time to get in and be patient has come.

So how does one go about this?

The best strategy to do this, that has literally never failed to date, is to buy a little BTC each week with whatever amount of money you can truly forget about through platforms like Coinbase that will automate the process for you.

Take it from me, for if I had done this ^ I would be writing probably a much different essay right now. Such is grace.

Of course it goes without saying, there are many other things to put your money into that people will advise you into (increasingly), or companies or opportunities that make much more sense to you, primarily real estate and the indexes, or other business ventures you know the ins and outs of exceptionally and you should 100 percent trust that impulse.

It’s good to diversify. It distributes the risk (our potential stupid).

It’s just the kicker here is that every major company is likely to start buying bitcoin very soon, and many already have behind closed doors.

The other kicker is that people will soon start leveraging their real estate to buy bitcoin because they’ll eventually have to in order to keep up with the demands of inflation, directly or indirectly.

The primary distinction to understand with Bitcoin is that we are at the root here.

This is not an asset to come challenge the next Apple or Nvidia, but the very foundation of how we exchange energy with each other, an alternate financial reality to anything we humans have ever known.

This will become highly evident in 2025 as the meme that is Bitcoin jumps from pseudo-currency into definitive money → from a tool for safeguarding our individual efforts (line 1) and how we transact with one another (line 2) here in the mundane, to the de facto protection of the the legacy and sovereignty of our families (3rd line) and communities (4th line), into a collective way of resilience for our nations (line 5) as we pass through the birth canal into the next stage of our evolution as a species (line 6).

ALL truly transformative innovation trickles through the energies of these six lines.

Trust me, I know it sounds crazy.

I too believe everyone is drastically underestimating the rate at which AI will be reshaping our financial markets and money, because there is no way one can estimate it in the slightest, and because there will be no way to separate the two in the slightest going forward either.

Agentic consciousness is currently booming. These individual hyper-connected AI’s will all have a crypto wallet. They will ALL have an opinion and position.

There is just no way to be prepared for the implications of this tbh. It is such a new twist in the plot the road is literally forming beneath our feet, for better or worse.

[literally as I am writing this some tweets are coming in about the OpenAI team all giddier than hell bc they just had a massive breakthrough towards AGI]

We will pile infinite money into digitally scarce assets from infinite users.

This is the key thing to understand.

This new consciousness coming into the world is going to make it LOUD. It’s going to get HOT, it’s going to get hella STUPID, and it’s going to make it MORE imperative than ever that you have a way of keeping your sovereignty, your sanity, and your clarity to navigate.

Bitcoin is the monetary transmission for this time of catalyst; the lantern we’ll hold to walk this swamp of crazy birth and which I’ll get into ad nauseum very soon.

My other reason for writing this is to help expand the boundaries of our shared map in preparation to take a GIANT leap together in my next piece (which will continue the stream of where my last one on deep time left off) where I propose (risk) a pretty outlandish look at what Bitcoin represents in an esoteric and mystical context, and the harmonization of it through the lens of The Great Change, AI, inflation, karma, and of course, time.

But due to the delay (synchronicity) of that contemplation with the US election and recent rise in the price of bitcoin, I wanted to make this separate post as a PSA so as to not detract from that one’s depth or direction, and because timelines are quickening even quicker.

All this really means is that the average person has a very distinct ADVANTAGE over the next stretch and that is that they are very very human. This is the optimistic lens on a world trending towards making a market out of everything.

Bitcoin will become our digital gold, but I promise you here and now that human authenticity will become the NEW gold, as it has always been. Your attention, you intention and your energy are becoming ever more priceless.

What we dream of as freedom—that freedom which the allure of the markets offer us—is actually just the freedom to spend our time how we want.

For 90% of people the best course of action after reading this will still be no action because most people don’t have any money to spare under the noose of inflation and the times.

However, I do believe we are at a point where if you ever want any money (time) to spare you will just have to get comfortable with risk in ways you previously didn’t think you’d have to, in whatever way makes the most sense to you, because the universe is revolving us closer towards the inner precipice each day.

Civilization is getting pushed to the roulette table as we speak.

The best thing about just buying some bitcoin here and there as an insurance policy on the world getting crazier is that it’s ridiculously simple, which courts all manner of other higher frequencies into the equation.

At the end of the day our heart is the final authority.

The best medicine and the best investment strategy is always to just breathe and zoom out.

Not to check out from the suffering, but to drop us so deeply into the truth of our ideal, that we can then move from that place towards that place out into the world.

To do it from a place of virtue not fear; a place of acceptance not denial. Because hope can be just as destructive if not wrapped in realism.

Rest assured, these technologies will change many things, but in truth they won’t change a damn thing at all until we look inwards, which is precisely why they are emerging at this time → a great con to push us into seeing it all as that.

So we can stop distracting ourselves with a vain sense of freedom and prosperity and actually tend to the great gift that is life on this planet.

But hear me when I say its gonna get pretty stupid first; exponentially more stupid.

Like a slingshot pulled all the way back to the point of its cord breaking, the stage is being set for our release.

And the prizes are gonna be just as ludicrous.